Personal Loans

Table of ContentsCar Finance BrokerCar Finance BrokerEquipment FinanceHorizon Finance Group Personal LoansEquipment Finance

An excellent broker functions with you to: Recognize your requirements as well as goals., attributes as well as charges). Apply for a finance as well as manage the process via to settlement.Some brokers obtain paid a typical charge regardless of what car loan they advise. Various other brokers obtain a higher cost for providing specific fundings - Horizon Finance Group Equipment finance.

If the broker isn't on one of these checklists, they are operating unlawfully. Consider your must-haves and also nice-to-haves Prior to you see a broker, think regarding what matters most to you in a house funding.

Truck Finance Broker

Make a checklist of your: 'must-haves' (can not do without) 'nice-to-haves' (might do without) See selecting a residence car loan for suggestions on what to consider. Finding a mortgage broker You can discover a qualified mortgage broker with: a home loan broker specialist organization your loan provider or financial establishment suggestions from individuals you understand Satisfying with a home loan broker Bring your listing of must-haves and nice-to-haves.

Obtain them to describe how each financing alternative works, what it costs and why it's in your ideal passions. If you are not delighted with any type of alternative, ask the broker to locate choices.

Questions to ask your home mortgage broker Ask inquiries. Just how do the charges and also features of this car loan impact exactly how much the loan will cost me? Get a composed quote from the broker A created quote informs you the: kind of funding finance amount lending term (period) present interest rate fees you have to pay (for instance, broker's charge, funding application charge, ongoing costs) Make sure you're comfortable with what you're concurring to.

Horizon Finance Group Adelaide

Never authorize blank types or leave information for the broker to fill up in later on. Problems with a home loan broker If you're miserable with the lending suggestions you've obtained or costs you've paid, there are actions you can take.

Price/interest price is a key element of the lending, the broker value proposal corresponds to considerably other even more than just ensuring that the customer receives a competitive interest rate for their provided circumstances. Brokers give a distinct mix of option, benefit, customised service and also suggestions with the expense of that consumer's introduction paid by pop over here the loan provider.

Car Finance Broker

Numerous customers might not know that together with house financings, Financing Brokers can help with service loans, vehicle loan, remodelling lendings as well as even wedding event lendings - Horizon Finance Group.

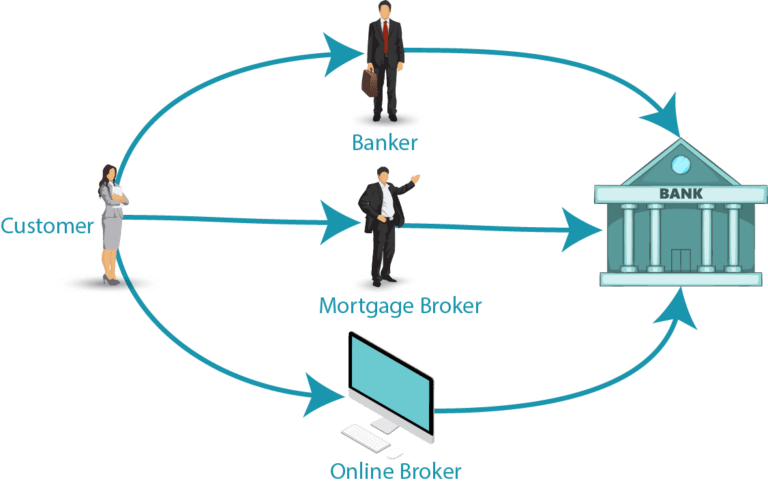

With numerous various economic terms to monitor, it's not constantly understandable the different roles as well as relocating parts of the monetary industry. What is a finance broker, as well as what do these individuals do? While a mortgage broker concentrates on house car loans, a financing broker specializes in a variety of different loans.

A money broker may be the secret to discovering what you're looking for. What Is a Financing Broker?

Horizon Finance Group Personal Loans

Money brokers function with banks, credit score unions, as well as various other monetary institutions to function in both the lender as well as the customer's best rate of interests. Why Make Use Of a Financing Broker? Why might you make use of a financing broker?